Articles

Knowledge Is Power

We’re here to advise.

Preparing for life’s changes and challenges is no easy task. We’re here to help you make smart financial decisions that push you to the next level of prosperity, and education is your best path to success.

Rely on us for honest, practical advice that can help you manage your money, invest and save, build good credit, buy a car or a home, and more. Whatever you’re striving toward, we’re here to help you get there.

The Latest Articles

-

![]()

Secured vs. Unsecured Credit—Know the Differences

There are many types of credit available, each with advantages. Find out what is meant by the industry’s name for each—then choose what works for you. -

![]()

Protect the Elderly from Financial Scams and Abuse

They are an age-old story: financial scams of the elderly. Here’s how to protect yourself. -

![]()

Seven Ways to Maximize Your Tax Refund

Getting a tax refund can give your financial health a little boost. Check out seven ideas on what to do with your refund money to have a long-lasting impact. -

![]()

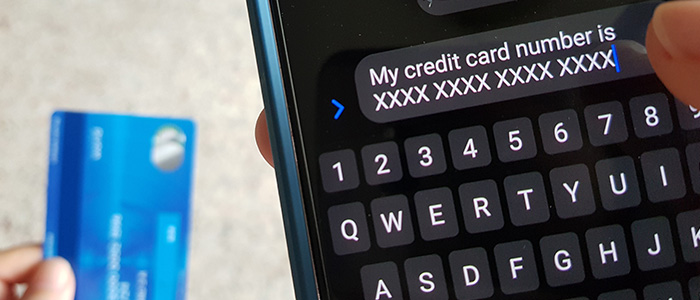

What Is Phishing: Understand Cyber Threats and Prevention

Many people fall victim to phishing, a crime in which attackers trick victims into giving them data or access to their accounts or their device. A little understanding can go a long way toward protecting your personal and financial data. -

![]()

Certificates: Low Risk and Reliable Return

When you have some cash saved up, you want to help it grow and keep it safe. A certificate could be the option that gives you the best of both worlds. -

![]()

Protect Your Password from Hackers

Protecting your password requires being savvy and diligent. Use these strategies to help keep your passwords and accounts secure. -

![]()

Buying a Home? Surround Yourself with the Right Team

If you are looking to buy a home, surround yourself with an experienced, trusted team of professionals. -

![]()

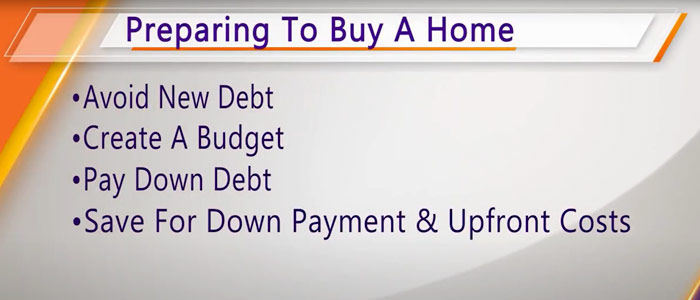

5 Things to Know Before You Buy Your First Home

Buying your first home is a huge milestone. Planning ahead can help you achieve the dream of homeownership. Consider these five essential tips to help you navigate the process smoothly, including budgeting, saving, searching, and more. -

![]()

How Do Home Equity Loans Work?

The equity in your home can be leveraged to help fund home improvements, emergency expenses and even college. Our Mortgage Services team can help you determine if a home equity mortgage is right for your situation. Learn more at Home Loans or call our Mortgage Services Team at (512) 997-HOME (4663) or (800) 476-8409. -

![]()

Finding or Financing? What Comes First?

It’s easy to get excited about shopping for your next home, but without knowing what you can afford, you could waste valuable time and miss out on great opportunities. Getting prequalified for your mortgage can speed your home search and improve your chances that your offer will be accepted. -

![]()

How to Build a Budget When Buying a Home

There are many upfront and ongoing costs when you purchase a home, and your regular monthly expenses can also change. Understand how to build your budget so you can be a prepared homeowner. -

![]()

Ready to Buy a Home? Here’s What Not to Do

You’ve heard all the advice about what to do to prepare, but there’s more to it than that. Before you begin looking at homes and negotiating a contract, you should know about some moves that could significantly hurt your chance of getting that home loan. Here are three things not to do when a new home purchase or even a refinance is in your future. -

![]()

Lifetime Membership Is Standard

Did you know that once you become UFCU Member, you’re a Member for life? Learn more about how UFCU is ready to be your financial partner, regardless of where life takes you. -

![]()

Get a Little Face Time — UFCU Your Way

There are only a few transactions that require in-person service, but we get it. Sometimes you need a little face time. Learn how to manage your finances in person with UFCU drive-thru service, ATMs, or lobby appointments. -

![]()

Three Tips for Managing an Inheritance

If an inheritance windfall comes your way, here are three tips for managing it wisely. -

![]()

Are You Ready to Retire? Ask Yourself These Seven Questions

If you are thinking of retiring, take this retirement readiness test. -

![]()

The 2025 Social Security Fairness Act, Explained

The 2025 updates to Social Security laws bring significant benefits for public sector workers, teachers, firefighters, and police officers. Ensure your information is current with the SSA to maximize these advantages and secure a brighter retirement future. -

![]()

Three Ways to Learn More About Investing

Are you eager to understand the world of Investments? Here are three ways you can get started on the path to becoming a knowledgeable investor.

.jpg?sfvrsn=c8202ce2_5)