Articles

Knowledge Is Power

We’re here to advise.

Preparing for life’s changes and challenges is no easy task. We’re here to help you make smart financial decisions that push you to the next level of prosperity, and education is your best path to success.

Rely on us for honest, practical advice that can help you manage your money, invest and save, build good credit, buy a car or a home, and more. Whatever you’re striving toward, we’re here to help you get there.

Understand Your Credit

-

![]()

How to Raise Your Credit Score in Three Easy Steps

If you take the time to monitor your accounts, pay off your debt, and be timely about paying your bills, you can prove that you are credit-worthy over time. -

![]()

What’s the Ideal Credit Score for Home Loans?

What can you do if you want to qualify or pre-qualify for a mortgage but are concerned your credit score is too low? The good news is that a low credit score is not permanent, and it’s one area you can start working on right away. Find out what credit score you need to buy a home and get five actionable steps to boost your credit score with the aim of homeownership. -

![]()

All About Credit Scores

In this guide, we’ll cover what credit score do you start with, ways to build credit, and answer common questions like what credit score is needed to buy a car. -

![]()

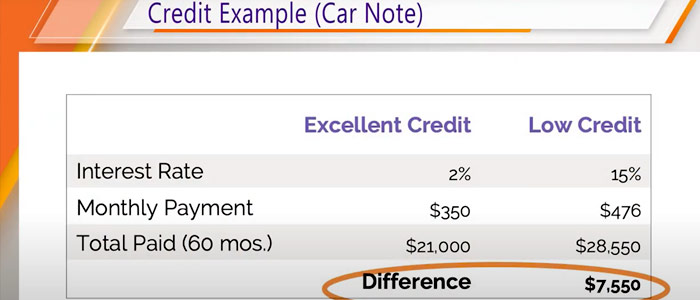

Six Tips for Improving Your Credit Score

Almost everyone has a credit card, but using them responsibly is key to building credit and boosting your score. These six practical tips show how to improve your credit score, maintain good credit, and use credit cards to your advantage—helping you reach financial goals and qualify for better loan rates -

![]()

Secured vs. Unsecured Credit—Know the Differences

There are many types of credit available, each with advantages. Find out what is meant by the industry’s name for each—then choose what works for you. -

![]()

Best Credit Cards for College Students

Calling all college students: We’re here to help you understand the basics of credit cards, how to choose the right one, and how to build credit in college. -

Understanding Your Credit Report

Learn the ABCs of your credit report, from how it’s compiled and what exactly it contains to how it’s used by creditors, what effects to expect from a negative report and more. -

![]()

Building Credit from Scratch

If your credit history is sparse, start now to build it up. Having little or no credit is easy to fix with time, patience, and a strategy. -

Ordering Your Credit Report

There are three major credit reporting agencies–Equifax, Experian and Trans Union. Learn how to check all three scores with one easy report through UFCU and myfico.com. -

Do You Check Your “Specialty” Consumer Reports Annually?

When guarding your credit score, you need to consider more than just the standard credit report. -

How UFCU Looks at Your Credit

University Federal Credit Union uses information from your loan application and your credit report to determine whether to grant credit under the terms you request. Learn what factors we consider. -

![]()

Improve Your Finances with a Personal Loan

Learn how a personal loan could be a great tool to help you improve your finances, whether you’re raising your credit rating, paying off debt, or trying to reach the next phase in your financial journey. -

![]()

Credit 101: Ways to Borrow Money

Have you ever wondered about the differences between credit cards, lines of credit, and personal loans? Discover the pros and cons of each of these ways to gain cash. -

![]()

A Closer Look at Credit

Used wisely, credit can be an excellent tool for helping you achieve your financial goals. To help put you on that path, we’ve collected some of the questions our representatives are asked most often, along with the answers. -

![]()

Rebuild Your Credit in Six Easy Steps

If you’re like most people, your credit score is only fair. If you have not yet achieved a rating of good or better, read on for five practical, doable steps you can take to get there. -

![]()

Five Behaviors for Finding Your Credit Zen

Our financial health is complex and composed of many important parts. Understanding how to spend intentionally is one of them, particularly when it comes to credit. If you’d like to reap the rewards that come with credit cards, consider these five behaviors we’ve identified as milestones on the journey to Credit Card Zen. -

![]()

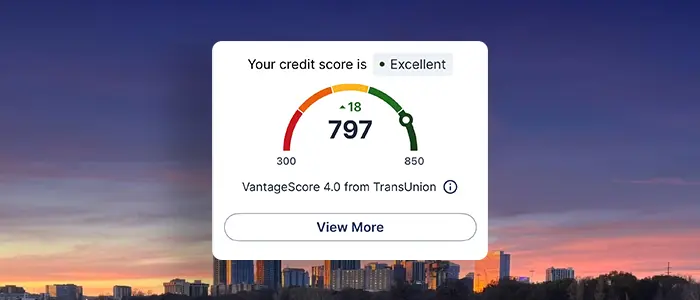

Everything You Need to Know About Credit Scores

Your credit score is important, and it can have a big impact on your future. Understand what your credit score is made up of, how to build good credit, and what steps you can take to stay in control. -

![]()

Credit Card Rewards—What’s in It for You?

Rewards credit cards give extra value just for making your normal purchases. Learn how these cards work and get tips for choosing one.