Articles

Knowledge Is Power

We’re here to advise.

Preparing for life’s changes and challenges is no easy task. We’re here to help you make smart financial decisions that push you to the next level of prosperity, and education is your best path to success.

Rely on us for honest, practical advice that can help you manage your money, invest and save, build good credit, buy a car or a home, and more. Whatever you’re striving toward, we’re here to help you get there.

The Latest Articles

-

![]()

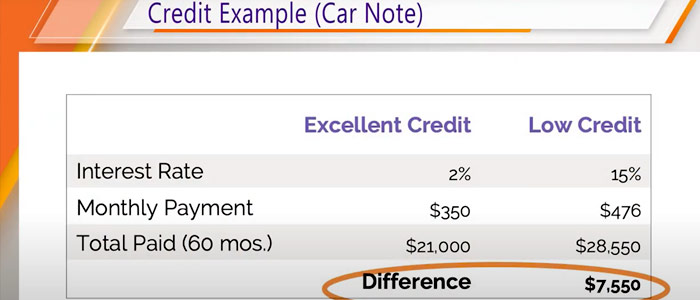

A Closer Look at Credit

Used wisely, credit can be an excellent tool for helping you achieve your financial goals. To help put you on that path, we’ve collected some of the questions our representatives are asked most often, along with the answers. -

![]()

Rebuild Your Credit in Six Easy Steps

If you’re like most people, your credit score is only fair. If you have not yet achieved a rating of good or better, read on for five practical, doable steps you can take to get there. -

![]()

Five Behaviors for Finding Your Credit Zen

Our financial health is complex and composed of many important parts. Understanding how to spend intentionally is one of them, particularly when it comes to credit. If you’d like to reap the rewards that come with credit cards, consider these five behaviors we’ve identified as milestones on the journey to Credit Card Zen. -

![]()

Everything You Need to Know About Credit Scores

Your credit score is important, and it can have a big impact on your future. Understand what your credit score is made up of, how to build good credit, and what steps you can take to stay in control. -

![]()

How to Protect Yourself When Shopping Online

Learn how you can protect yourself from potential fraudsters while shopping online. -

![]()

Three Things the IRS Will Never Do

As many people begin to get their finances in order in anticipation of tax season, fraudsters may also be at work. Avoid being misled by scammers by arming yourself with knowledge. Here are three things the IRS will never do. -

![]()

Multi-Factor Authentication — What to Know

Multi-factor authentication helps ensure that only you can access your UFCU accounts through and helps protect your personal information from fraud and identify theft. -

![]()

What to Do If You Suspect You're a Victim of Fraud

If you suspect you’re a victim of fraud, here’s a list of five action items you can take to recover as quickly as possible. -

![]()

Tips for Cybersafety, After a Disaster

Consider these tips to confidently give to relief efforts and deter fraudsters after disaster strikes. -

![]()

Top 10 Ways to Evade Fraudsters during a Crisis

Not everyone responds to a crisis with kindness. Learn about three common scams and ten ways you can protect yourself. -

![]()

Our Representatives Are Standing By — UFCU Your Way

While you can almost always manage your finances achieve most of your banking needs remotely, sometimes you need to talk to a representative. Learn the circumstances under which a phone call is your best bet. -

![]()

Avoid Holiday Delays — Manage Your Money in Every Season

Official holidays can mean a day off for your financial institution, so be sure to add getting your banking done early to your list of holiday preparations. Get tips for managing your finances in every season. -

![]()

Managing Daily Finances Together — Is a Joint Account Right for You?

How do individual and joint bank accounts differ? Many people consider getting joint checking or savings accounts for shared expenses. Joint accounts have advantages, but there are also down sides. Learn the pros and cons of each before you decide what’s right for you. -

![]()

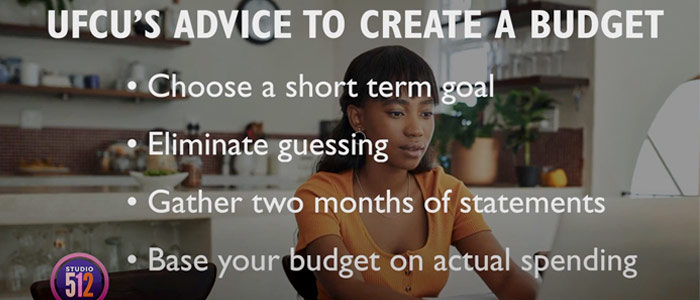

Control Spending

No matter your current financial situation, spending your money wisely makes sense. Being intentional about your money helps you use it on things that really matter to you. Follow these simple tips to set up and stick with your budget. -

![]()

Navigate Financial Stress

Financial stress impacts everyone. It doesn’t have an income or age limit, and we all go through it at some point in our lives. Fortunately, there are strategies to help prevent and reduce financial stress. -

![]()

Budgeting for a Staycation

Need a vacation? You don’t have to break the bank to do it. Instead, get much-needed R&R by taking a staycation. Consider these tips to keep your vacation fun and on budget. -

![]()

Four Easy Ways to Save Money

Have you mastered the skill of saving money? Consider these four tips for building up your savings. -

![]()

Pay Yourself First!

Take a deep dive into what it means to pay yourself first, and how you can achieve this goal consistently.