Articles

-

![]()

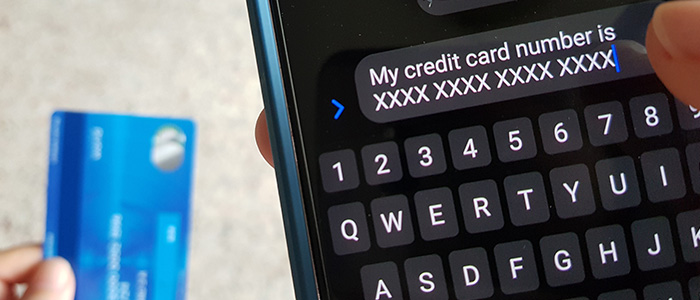

Self-Defense Against Scammers

Be wary of emails and texts that ask you to share sensitive information. Remember: If UFCU calls asking for your login details, it’s not really us. Learn to defend against scammers. -

![]()

How to Start Budgeting: Essential Steps for Financial Success

Creating and adhering to a budget might seem challenging, but it’s one of the best steps you can take to stay on top of your finances. -

![]()

Car Shopping? Here’s How to Drive Away Happy

Are you ready to buy a new car but dreading the car shopping process? Our five-step D.R.I.V.E. Method can turn your car buying into fun, and help you drive away happy in the perfect vehicle for you. -

![]()

What Is Phishing: Understand Cyber Threats and Prevention

Many people fall victim to phishing, a crime in which attackers trick victims into giving them data or access to their accounts or their device. A little understanding can go a long way toward protecting your personal and financial data. -

![]()

What’s the Ideal Credit Score for Home Loans?

What can you do if you want to qualify or pre-qualify for a mortgage but are concerned your credit score is too low? The good news is that a low credit score is not permanent, and it’s one area you can start working on right away. Find out what credit score you need to buy a home and get five actionable steps to boost your credit score with the aim of homeownership. -

![]()

Seven Ways to Maximize Your Tax Refund

Getting a tax refund can give your financial health a little boost. Check out seven ideas on what to do with your refund money to have a long-lasting impact. -

![]()

Five Ways to Protect Yourself from Tax Scams

Can you spot a tax scam? Get five tips to protect yourself from fraudulent schemes and learn about IRS impersonators, fake tax preparers, and other tax scammers. -

![]()

When to Refinance Your Auto Loan

Refinancing your car loan can save you money in interest and lower your payments. Is now a good time to refinance? Consider these five tips before you decide. -

![]()

For Love or Money—What to Know About Romance Scams

Romance scammers cheat thousands of people out of their money each year. They will tell you almost anything to get your money. Practice these 5 tips to avoid romance scams, outsmart scammers, and keep your money. -

![]()

Certificates: Low Risk and Reliable Return

When you have some cash saved up, you want to help it grow and keep it safe. A certificate could be the option that gives you the best of both worlds. -

![]()

Protect Your Password from Hackers

Protecting your password requires being savvy and diligent. Use these strategies to help keep your passwords and accounts secure. -

![]()

Protect the Elderly from Financial Scams and Abuse

They are an age-old story: financial scams of the elderly. Here’s how to protect yourself. -

![]()

Protect Your Credit Cards

Credit card fraud is on the rise. Learn steps to prevent fraudulent charges, discover how card issuers can help, and react effectively to unauthorized purchases on your credit card. -

![]()

Are You Paying Too Much for a New Car?

At UFCU, you are not a loan number or a quota to meet. You are a Member whose best interest is our best interest. When you are ready to buy a car, our seasoned lending team stands ready to help you get the car you want on the best possible terms for your situation. -

![]()

What Makes a Great Home Insurance Policy

In an unpredictable world, your financial future can be affected by what’s in your homeowners insurance policy. Learn its components and discover our tips on each. -

![]()

How Do Home Equity Loans Work?

The equity in your home can be leveraged to help fund home improvements, emergency expenses and even college. Our Mortgage Services team can help you determine if a home equity mortgage is right for your situation. Learn more at Home Loans or call our Mortgage Services Team at (512) 997-HOME (4663) or (800) 476-8409. -

![]()

Preparing for Life on Your Own

Joyful or nervous about moving to your own place? Either way, here are payment and saving tips for life on your own. -

![]()

Jump-Start Saving

Check out these ways to start an emergency fund—even when it seems like life is all emergency and no funds.

.jpg?sfvrsn=c8202ce2_5)