Articles

-

![]()

Enjoy Your Holidays by Building a Budget

The holidays should be a time of joy — not a time for worrying about your account balance. Create your spending strategy to find the perfect gifts for the people you cherish without going over budget. -

![]()

Top Socially Distanced Weekend Vacays for Austinites

Feeling in need of a vacation lately? We feel you. And we’re here to tell you that you don’t have to book a plane ticket to completely escape work pressures and life stresses for a few days. -

![]()

How to Enjoy Austin from the Comfort of Your Car

With its legendary music and art, hometown guitar heroes, and barbecue messiahs, the spirit that runs through Austin is something that stays alive no matter what. And even when things feel a little “weirder” than usual around the ATX, you can still experience the best of our town without ever having to leave your car. You just have to know where to drive. -

![]()

Planning a Trip? Take Your Credit Union with You

Get our checklist of important tasks before you hit the road, and make it the best vacation ever. -

![]()

How to Stop Robocalls (Know When to Say Hello)

Unwanted phone calls plague mobile and landline users alike and put you at risk for falling for a scam. Consider these tips for spotting unwanted calls and blocking them altogether. -

![]()

Navigating Finances after Divorce

A divorce can be emotionally — and financially — difficult. These steps are important to protect your assets and manage your finances.

*Investments offered through LPL Financial (Member FINRA/SIPC)

-

![]()

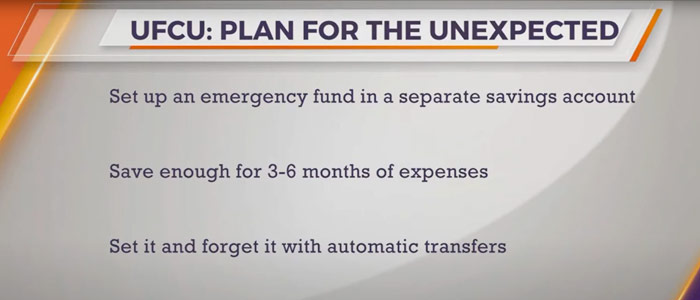

Plan for the Unexpected

Emergencies and the unexpected happen—it's life. But with a few simple steps, you can prepare your finances for whatever comes your way and safeguard your future. -

![]()

Skills You Need to Save

Saving helps you plan for the future and provides a safety net in case of an emergency. Learn different saving methods and how to stay motivated so you can achieve your goals. -

![]()

Navigate Financial Stress

Financial stress impacts everyone. It doesn’t have an income or age limit, and we all go through it at some point in our lives. Fortunately, there are strategies to help prevent and reduce financial stress. -

![]()

Good Debt

Most people encounter some form of debt in their lives. However, some debts are considered better than others. Understand how debt works, know where to go for help, and create a plan to better manage your debt. -

![]()

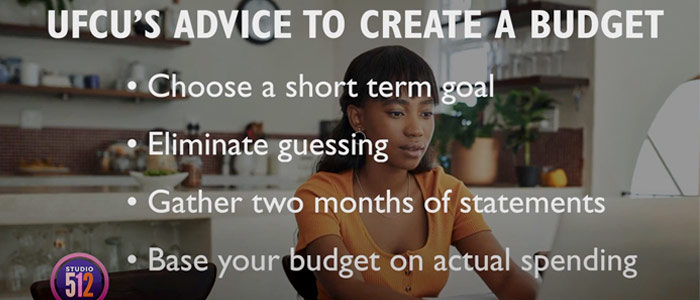

Control Spending

No matter your current financial situation, spending your money wisely makes sense. Being intentional about your money helps you use it on things that really matter to you. Follow these simple tips to set up and stick with your budget. -

![]()

Managing Daily Finances Together — Is a Joint Account Right for You?

How do individual and joint bank accounts differ? Many people consider getting joint checking or savings accounts for shared expenses. Joint accounts have advantages, but there are also down sides. Learn the pros and cons of each before you decide what’s right for you. -

![]()

Build Your Budget Back-Up Plan

Any time potential financial hardships could be on the horizon, it’s good to think ahead and consider how you might approach contingency planning should you have to weather tougher storms. Consider these five steps to contingency planning for your budget. -

![]()

Avoid Holiday Delays — Manage Your Money in Every Season

Official holidays can mean a day off for your financial institution, so be sure to add getting your banking done early to your list of holiday preparations. Get tips for managing your finances in every season. -

![]()

Six Reasons to Go Paperless

If you’re looking to reduce clutter, bank more securely, and save time and money, it’s time to make the switch to paperless options. -

![]()

Six Steps for Speedy Drive-Thru Service

Drive-thrus are one of many ways UFCU provides Members to take care of their banking business. Preparing ahead for your drive-thru visit can help minimize wait time, and get you on your way sooner. -

![]()

Lifetime Membership Is Standard

Did you know that once you become UFCU Member, you’re a Member for life? Learn more about how UFCU is ready to be your financial partner, regardless of where life takes you. -

![]()

Our Representatives Are Standing By — UFCU Your Way

While you can almost always manage your finances achieve most of your banking needs remotely, sometimes you need to talk to a representative. Learn the circumstances under which a phone call is your best bet.