Early Withdrawal from a Retirement Plan

Withdrawing money from a retirement plan before retirement is something that many people consider at some point. The circumstances in which it is allowed are limited. And even if you can do it, it may not be a good idea. Few people want to work until the day they die, and saving enough for retirement takes time and dedication. When you withdraw early, you are not just losing the amount you take out, but you are also losing all of the earnings it would have brought you over time. However, you may be in a position where you feel that you have no other way to avert financial disaster. The information below discussed the rules on withdrawing from different types of retirement funds.

401(k)/403(b)

Once you reach 59½ , you can take withdrawals from these accounts penalty-free, regardless of whether you are working (although plan administrators can elect to not allow current employees to take withdrawals). You must pay regular income taxes on withdrawals.

Penalty-free withdrawals before 59½ are allowed under the following circumstances:

- If you are “separated from service” (through permanent layoff, termination, quitting, or retiring) after turning 55 or older

- If you are separated from service and elect to receive “substantially equal periodic payments” (withdrawals of equal amount based on life expectancy – they must last for at least 5 years or until age 59½, whichever is later)

- If you are permanently disabled

- If you die and the funds are distributed to your beneficiary

- If you have unreimbursed medical expenses that exceed 7.5% of your adjusted gross income

- If you are required by a court order to hand over money from the account to an ex-spouse or dependent

Hardship withdrawals are permitted in limited situations of immediate and severe financial need if you cannot obtain the money from elsewhere. A penalty of 10% of the withdrawal amount is assessed. Acceptable expenses the funds can be used for include:

- Qualified unreimbursed medical expenses for you or your immediate family

- Qualified higher education expenses for you or your immediate family

- The purchase of a primary residence

- Payments necessary to prevent eviction from or foreclosure of your primary residence

- Qualified repairs of damage to your primary residence

- Funeral expenses

You can also cash out your retirement plan when you leave your job, regardless of your financial circumstances, but you will have to pay the 10% penalty unless you meet one of the non-penalty conditions.

Note: The above information only describes the rules set by the IRS. Employers are not required to allow their employees to take withdrawals. Contact your plan administrator for the specific terms governing your 401(k) or 403(b).

Traditional Individual Retirement Account (IRA)

Like with 401(k)s and 403(b)s, you can make withdrawals penalty free once you reach 59½. Regular income taxes are assessed on all withdrawals.

A withdrawal before age 59½ is considered an early distribution and subject to a 10% penalty unless the money is used for one of the following:

- First-time home purchase (up to $10,000)

- Unreimbursed medical expenses that exceed 7.5% of your adjusted gross income

- Medical insurance if you are unemployed and received unemployment insurance for at least 12 weeks

- Qualified higher education costs

- Satisfaction of a levy by the IRS

Also, a penalty is not assessed if you:

- Die and the funds are distributed to your beneficiary

- Are permanently disabled

- Are receiving distributions in the form of substantially equal periodic payments

- Are rolling over the funds to another IRA

Roth IRA

No ordinary income taxes or penalty is assessed on qualified distributions. In order for a distribution to be qualified, it must meet two conditions:

- It is made at least five years after the year in which you first established a Roth IRA. (However, for withdrawals of funds that come from a conversion/rollover of a traditional IRA or employer-sponsored plan to a Roth IRA, it is five years from the conversion, even if you established a Roth IRA before that.)

- You have a qualifying reason for the distribution: you are at least 59½, permanently disabled, or using the funds to purchase your first home (can take out a maximum of $10,000), or the proceeds are distributed to your beneficiary after your death.

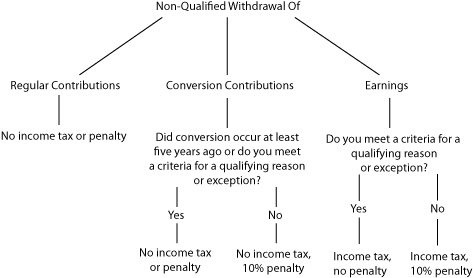

How other withdrawals are treated depends on what you are withdrawing. According to the IRS’s ordering rules, withdrawals first must be taken from your regular contributions, then, if that is exhausted, conversion contributions, then earnings.

Regardless of the circumstance, you do not have to pay income taxes or a penalty on distributions that are a return of your regular contributions.

You do not have to pay income taxes or a penalty on conversion contributions withdrawn after the five-year mark. For withdrawals before then, no regular income taxes are owed, but you have to pay a 10% penalty unless you meet either one of the criteria for a qualifying reason or one of the following exceptions:

- The funds are used to pay for unreimbursed medical expenses exceeding 7.5% of your gross income

- The funds are used to pay for medical insurance if you are unemployed and received unemployment insurance for at least 12 weeks

- The funds are used to pay for higher education costs

- The distribution is part of a series of substantially equal periodic payments

- The distribution is due to a levy by the IRS

- The distribution is a qualified, reservist, disaster recovery assistance, or recovery assistance distribution

Non-qualified withdrawals of earnings are subject to a 10% penalty and regular income taxes unless one of the qualifying reasons or exceptions is met. In this case, the penalty is waived but not the income taxes.

* This publication is only intended to be used for general informational purposes. Consult a tax professional for personal advice.

© Balance

www.balancepro.org · (888) 456-2227

For a no-cost consultation, contact a CFS* Investment Representative by phone or email.

Thank you for your feedback.